Excel Template Cash Flow Forecast M15.

Implementation of Cash Flow Forecasts Advanced Reports.

Uncertainty about the possible lack of money in the company’s accounts?

Constant liquidity tensions?

Lack of knowledge of future funds to be able to make investment or financing decisions?

If this is your case, then you urgently need a reliable Cash Flow Forecast Report that allows you to anticipate the future.

Many companies are suffering from a terrible situation of lack of liquidity, the treasury is trembling, significant cash flow tensions are going to be generated.

Profitable businesses that should be generating positive cash flow are seeing their available funds shrink at an alarming rate.

If the current situation is worrying, what will be the situation in the coming months?

Do you know how long you can hold out with the current situation?

Do you know the financing you need to be able to survive during the next few months?

If you have never had the need perform a professional cash flow forecast or if you need an agile and reliable system that allows you not only to visualize future scenarios but also to make decisions RIGHT NOW to guarantee the survival of the company, I introduce to you the EXCEL CASH FLOW FORECASTS system adapted to the information and needs of your company.

An agile and efficient system that I can update quickly so that you only have to analyze the situation and make quick decisions.

What problems can you have when preparing a Cash Flow Report?

A priori, developing a cash forecast system seems like a simple task, but when it comes to putting together all the pieces of which it is made up, it can be a real challenge. These are some of the problems that companies usually encounter when it comes to elaborate a CASH FLOW FORECASTS report:

1) The information comes from different sources, so it usually links the information from different Excel Workbooks in the Treasury Forecast Report book.

This results in a loss of control of the source information and there is a risk of making errors in the formulas or that some data is not updated.

2) A lot of work when the update month changes. Since the books are linked to the report, when the month is changed, all linked formulas must be changed manually.

This generates a lot of manual work, so the preparation of the report usually takes a long time. Consequently, the cost of updating data is very high and the report generation can take several days or weeks.

3) Not all the variables that may affect future cash are considered, so the information presented in the Cash Flow Forecast report may generate uncertainty, mistrust and cause erroneous decisions.

What variables are considered in the CASH FLOW FORECASTS reports that I configure and adapt to companies?

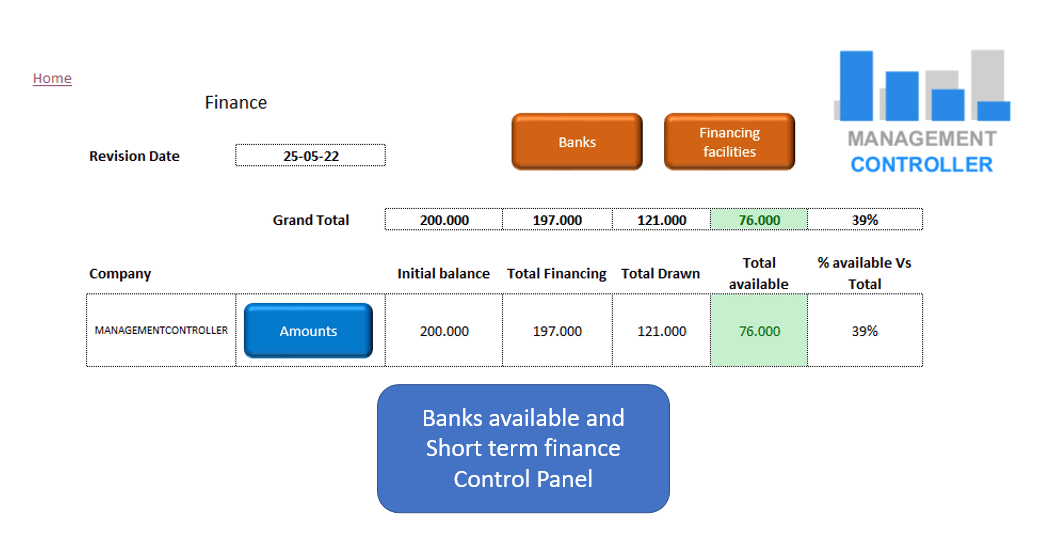

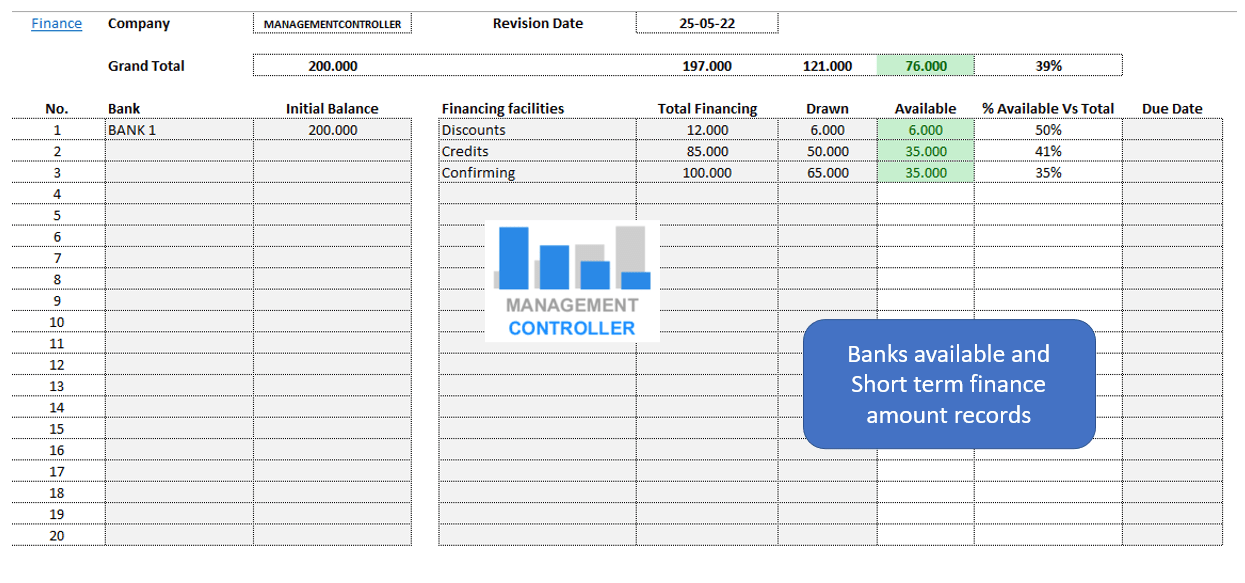

Initial balances in banks and financing available to cover operational needs for funds (credit lines, discount lines, confirming…)

Balances in portfolio of accounts receivable from customers

Balances in portfolio of accounts payable from suppliers

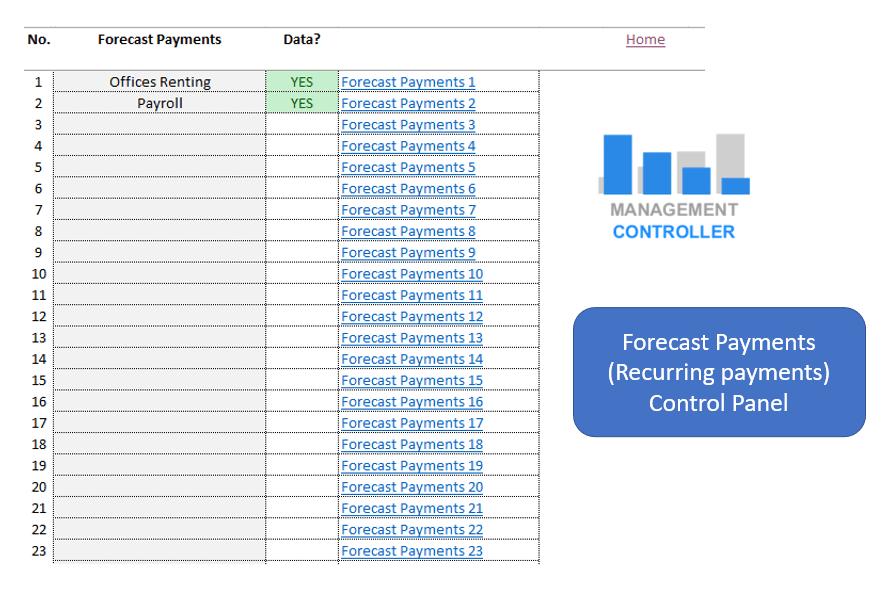

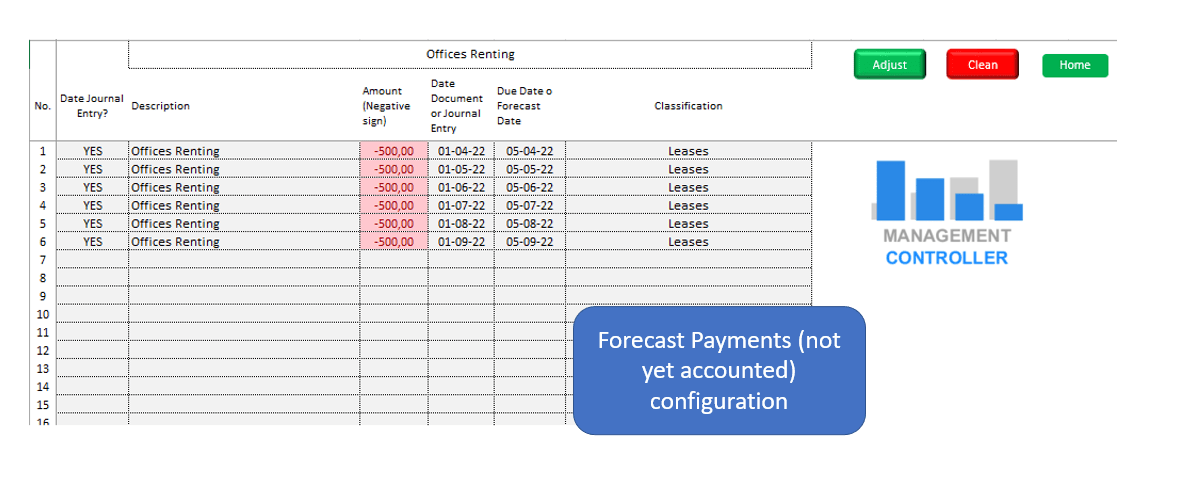

Recurring payments, taxes and investments

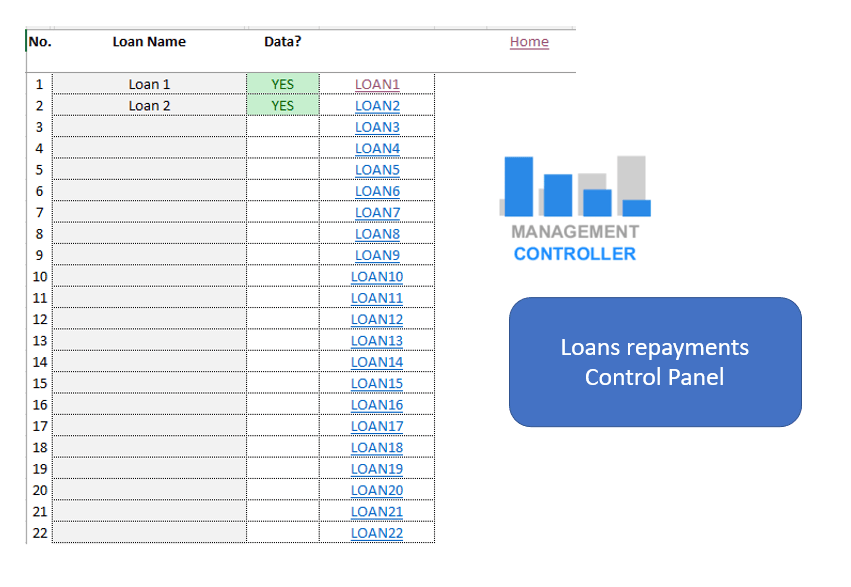

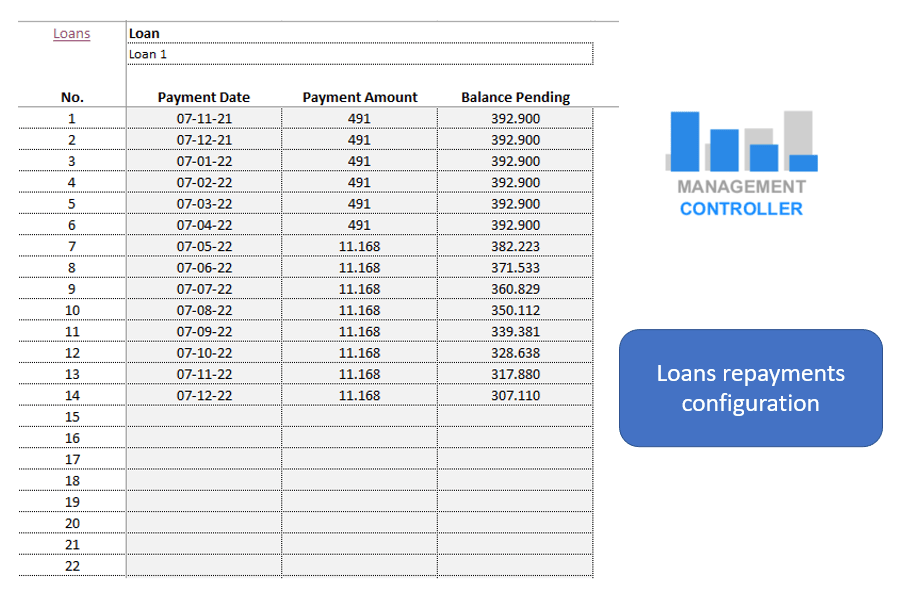

Repayment of loans

Confirmed sales and purchase orders pending invoice

Possibility of integrating several companies of the same group and making consolidated reports.

The report can be fed with the data downloaded to Excel from any ERP such as SAP, NAVISION, ODOO, SAGE…

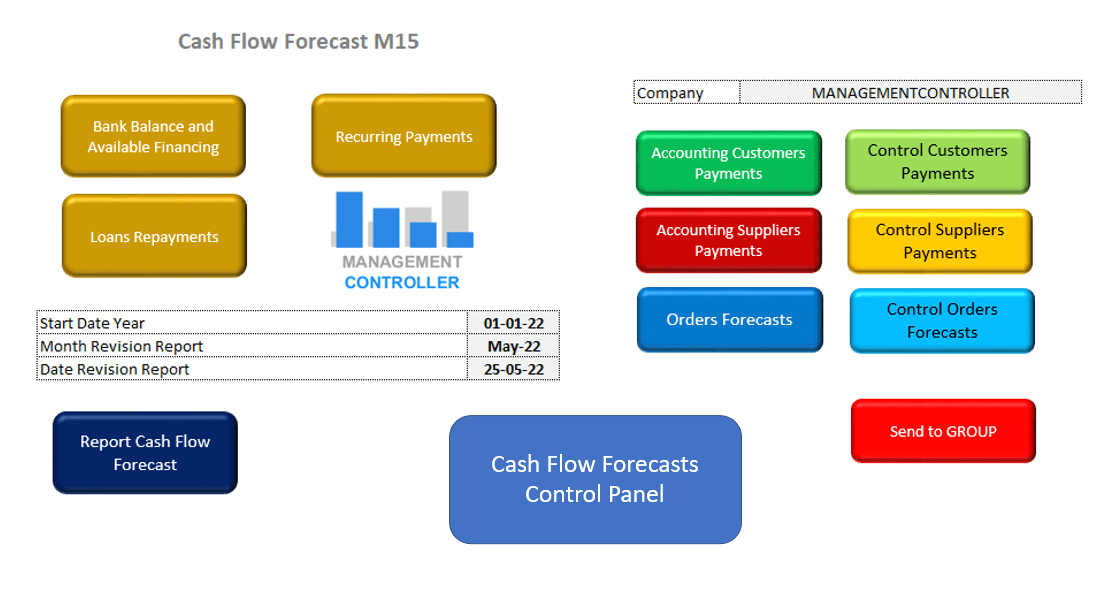

How works Excel Template Cash Flow Forecast M15?

Management Control tools provide continuous improvements to companies, but while continuous improvements are generated, the Controlling services provided also evolve and improve.

Continuous improvement is a philosophy embedded in my DNA, everything that can provide better information to management, maintain tools faster and easier and implement in less time is what I work on every day.

One of the tools that I implement in the companies to which I provide a Controlling service is the Cash Flow Forecast.

Perhaps you will think that an Excel report is not as powerful as if it were made in a computer program or an integration into an ERP.

Integration in an ERP can have its advantages, although this tool feeds on information provided by the ERP, but it also manages information that is not available in the ERP and that does not take much time when configuring and managing.

This tool is designed to greatly facilitate the user’s work and has a structure that makes it very easy to understand and at the same time has a great flexibility of adaptation according to the information available in the company and its needs.

This type of key report for the company could be integrated into an ERP but it would not have the same ease of use, maintenance and understanding and would possibly generate much more administrative work time than doing it this way.

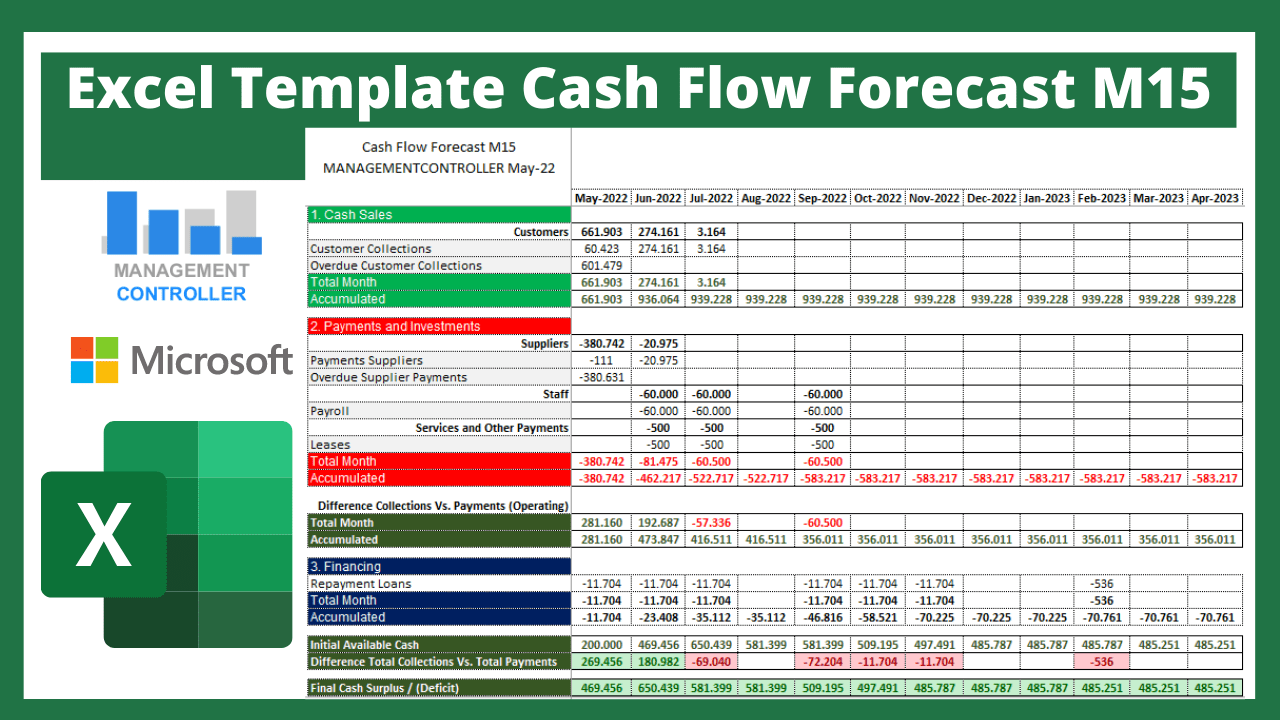

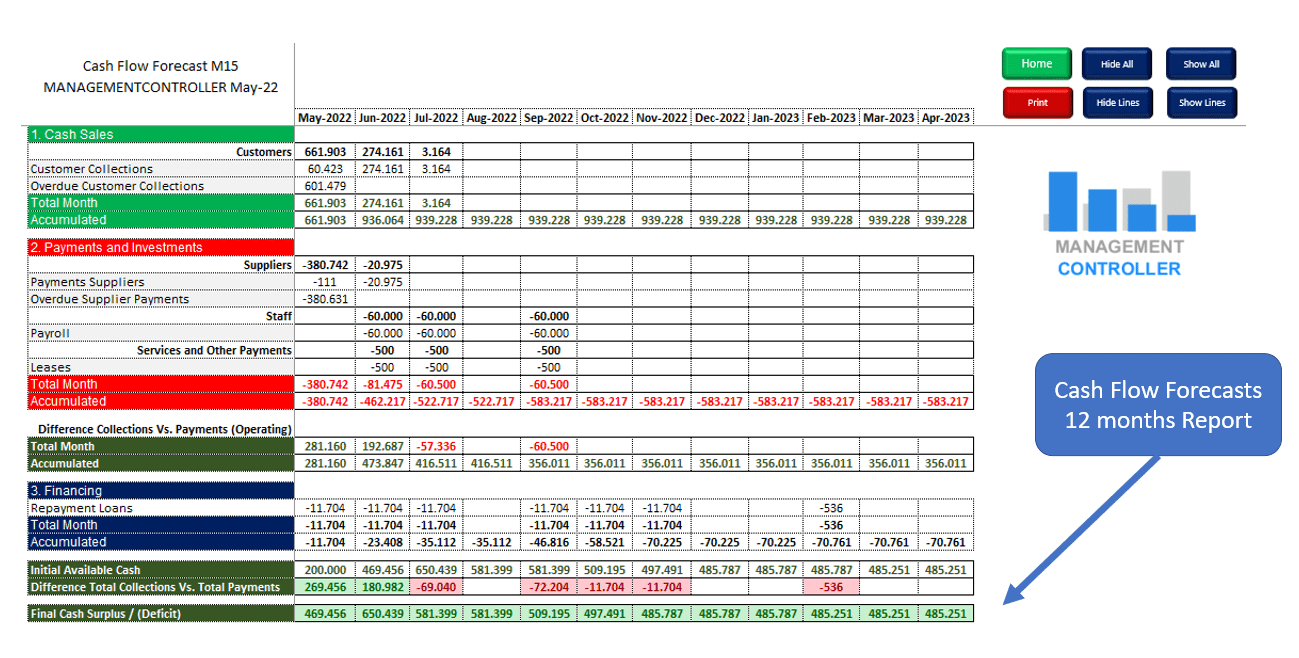

The Excel M15 Cash Flow Forecasts report is structured into 3 clearly differentiated types of information that together process and calculate the necessary forecasts so that the company can control its treasury or liquidity position for the next 12 months and can make decisions or take actions.

Liquidity is essential for companies as it is what makes them work. A company can be profitable, but if it does not have enough liquidity, it may have to cease its activity.

This is not usual since profitable companies usually generate enough liquidity to avoid having financial problems.

Even so, profitable companies need to know how much liquidity they are going to generate in the coming months to make decisions regarding external financing needs, investments, possible increases in expenses and achieve an optimal financial balance between external and internal financing.

The problem is usually those companies with negative profitability maintained over long periods or whose profitability is so small that it can generate tensions in the treasury due to temporary differences between collections and payments.

Companies with short average payment terms and long average payment terms may have liquidity problems if profitability does not accompany them.

That is why there is a close relationship between profitability and liquidity, whose main difference between them is the timing of collections and payments.

Not all expenses are paid when they are generated, there are temporary differences that cause the periods to be lengthened or shortened.

Therefore, profitability and liquidity will hardly coincide, but they do have a close relationship.

Coming back to the Excel M15 Cash Flow Forecast Report, I am going to explain how the information is structured, and what relationship there is between it to prepare the report with reliable data so that the company can make good decisions.

In this essential Management Control tool there are 3 types of information.

Present information available in accounting and management, which are the balances of the banks at the date of review of the report and the available balance of possible operational financing lines that the company has contracted, such as credit policies, discount lines, confirming, comex …

If this information cannot yet be obtained from accounting, it can be easily extracted from the information of the bank accounts that the company has, so it is very easy to obtain.

It is the only information that will be current as of the review date of the report and that will be the starting point of the report.

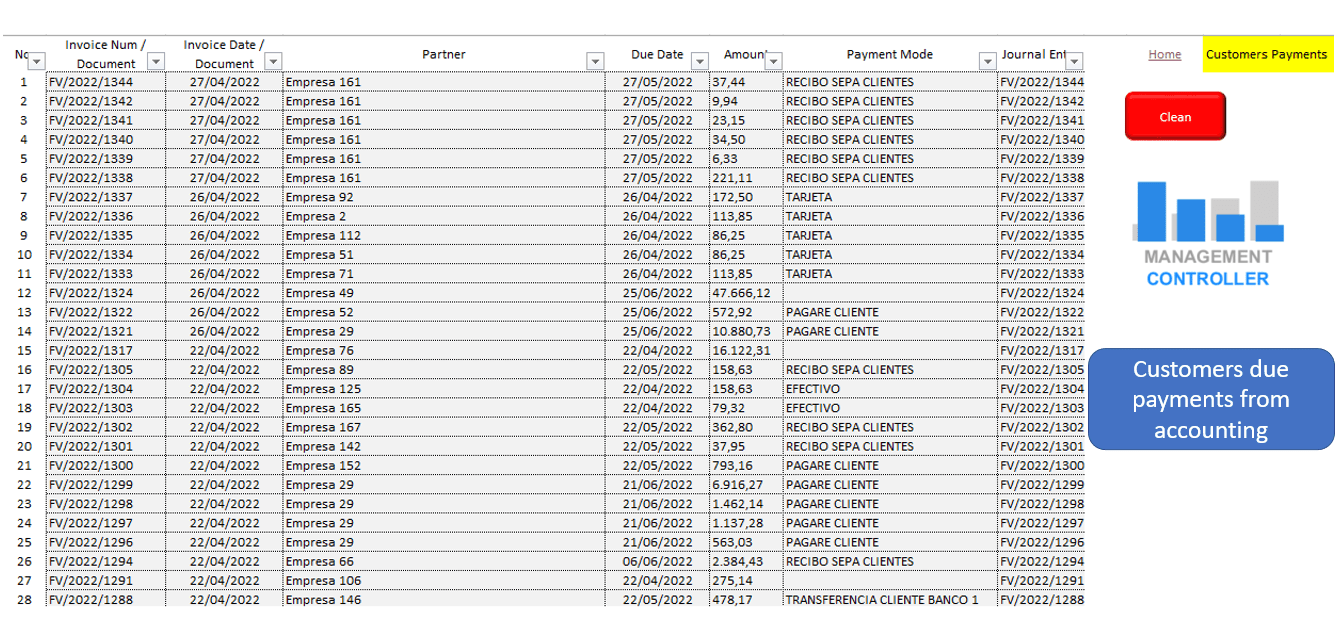

Documents receivable and payable accounted for but pending collection and payment, this information is available in the ERP or Management Program and is easily added to the report each time you need to update the report review date.

These documents to be collected and paid can be total invoices pending collection and payment, partial invoices or another type of document in collection or payment management such as SEPA transitory payments.

The important thing about this information is that it is already booked, and the only thing left is to collect or pay it supposedly according to the expiration date of each document.

And the third type of information that must be configured and maintained in the cash forecast report are those payments that we know we are going to have but that have not yet been booked, that means, recurring payment forecasts that have not yet been booked.

What types of payments are usually included in this section?

For example, rents, payroll, social security payments, taxes, insurance, receipts for supplies (electricity, water…), professional services or maintenance companies, repayment of loans…

With these 3 different types of information, clearly structured, we put them all together and obtain the expected final balances that we are going to have each month with or without the coverage of the financing facilities.

Essential information for any company that needs to have peace of mind regarding future liquidity.

Images the Excel M15 Cash Flow Forecast Report

Download Excel Cash Flow Forecast Report M15

More information about Controlling Excel Tools

- Excel Template Cash Flow Forecast M15

- Warehouse Inventory Control Free Excel spreadsheet

- Cash Flow Control M1 Free Excel Template

- Employee Costs Allocation to Cost Centers Free Excel Template

- Personal Finance Free Excel Template

- Excel Budget BOM Manufacturing Costs and Margins M15

- Wedding Budget Control M1 Free Excel Template

- Planning and Control Projects Costs and Profitability Excel FREE Template M15

- Financial Plan M3 Free Excel Template

- Restaurants Sales forecast Free Excel Template

- 3 Methods Selling Price Calculation Free Excel Template

- Employee Management Free Excel Download

- Multiproducts Breakeven Simulator Free Excel Template

- Travel Expenses Control M1 Free Excel Template

- Timesheet Control and Report Free Excel Template

- Working Hours Timesheet Free Excel Template

- Training Management Free Excel Spreadsheet

- Pickleball and Padel Sport Club Profit Analysis Free Excel spreadsheet

- Digital Marketing Dashboard Control M1 Free Excel Template

- Balanced Scorecard M1 Excel Template

- Payments Forecast Control FREE Excel Template

- Budget Sales Control Free Excel Template

ERP ODOO Functional Consultant and Controller (Management Control & Controlling)