Employee Costs Allocation to Cost Centers Free Excel Template.

More and more companies need to allocate indirect costs for their application to the cost of the product or service.

Depending on what type of cost calculation (direct, indirect manufacturing cost, total full costing, ABC …) you will need to make an allocation of the indirect ones or not.

Employees who do not participate directly in the elaboration of a product or in the performance of a service is an important indirect cost.

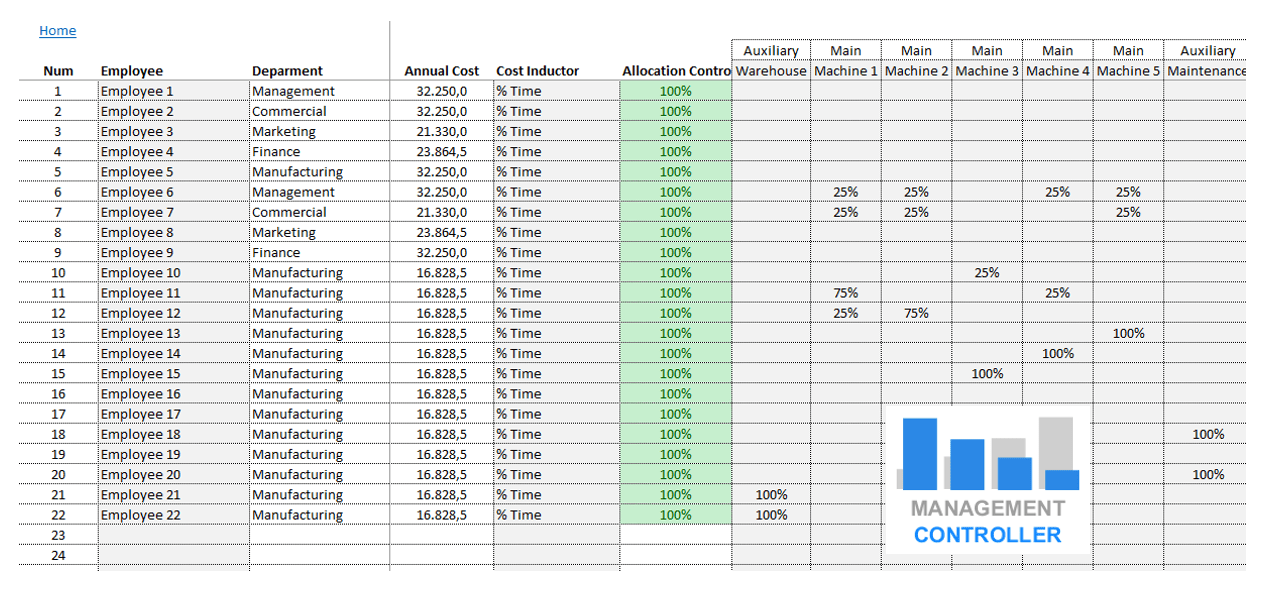

In this example we see how we can allocate the budgeted or projected annual cost of employees among the different main and auxiliary cost centers in order to accumulate the different types of indirect costs.

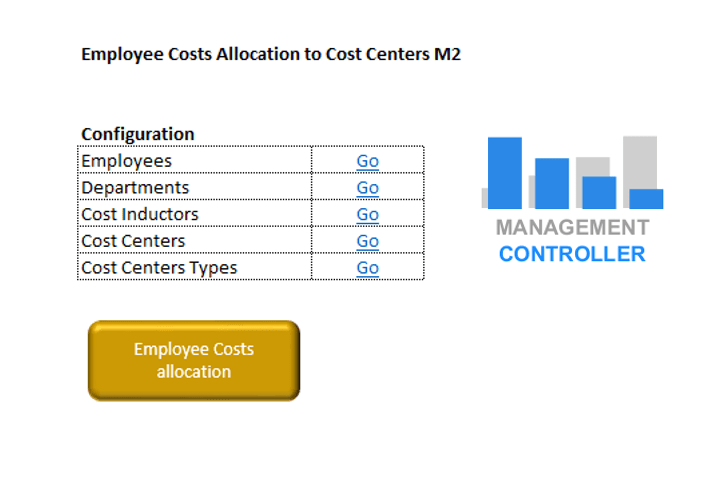

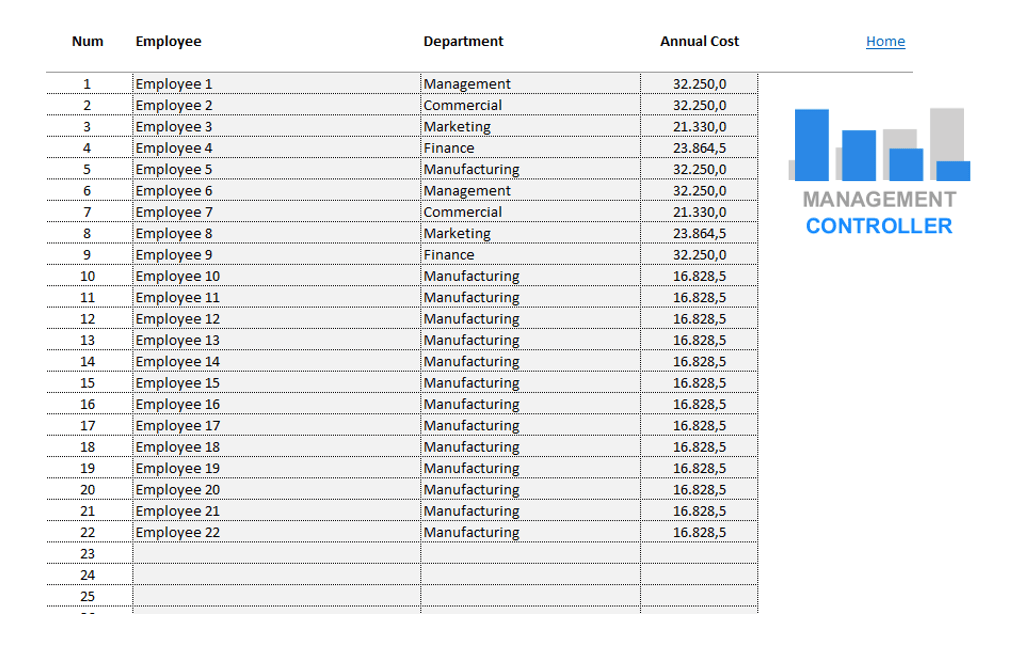

In this template made with Excel you can define the employees whose cost we will allocate, you can assign a previously defined the department and you will assign the corresponding budgeted or planned annual cost.

At the same time we can define the inductor costs to be used and the different cost centers, classifying them into Main and Auxiliary.

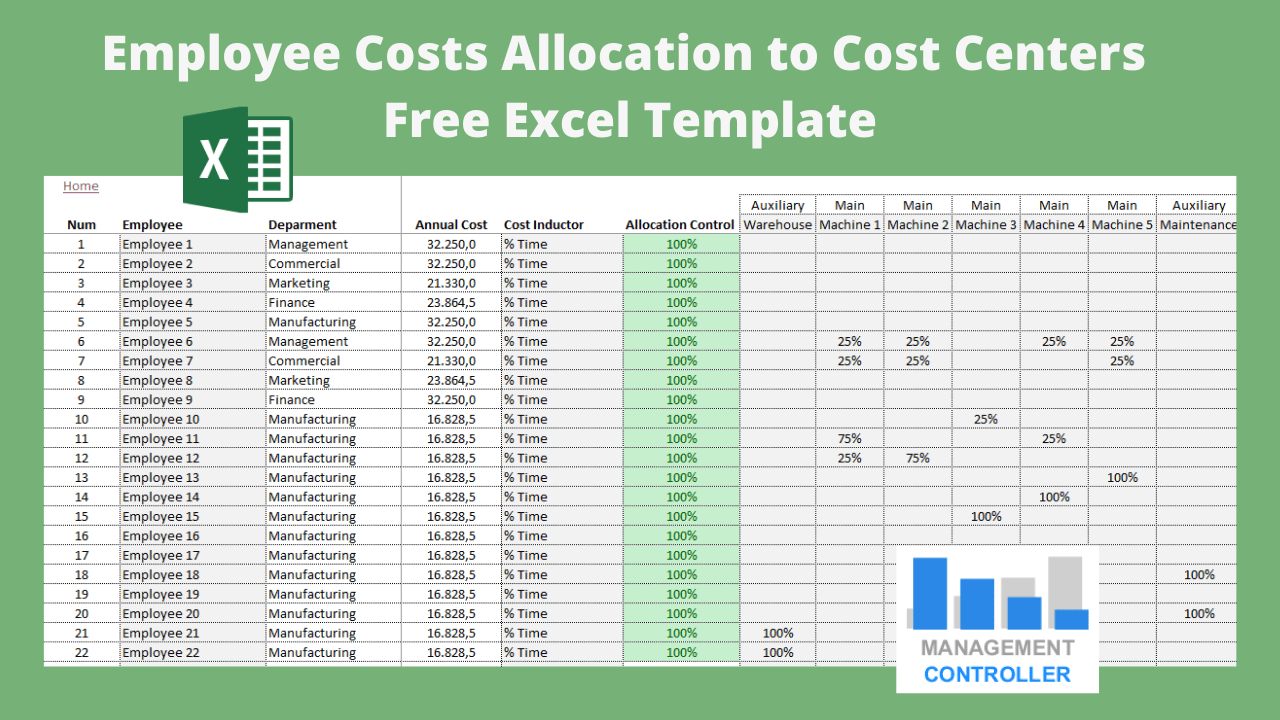

In the sheet “Employee Costs Allocation” we will select employees and cost centers.

Selecting the employees will show the department and the annual cost that will be allocated to the cost centers.

We will also select for information the inductor cost to be used.

The distribution is made on a matrix basis, for each employee is assigned a percentage to their corresponding cost center. If the percentage is 100% it means that the assignment is complete. Various percentages can be distributed throughout the different cost centers, that is, 40% to one cost center and 60% to another center. The important thing is that the total percentages have to add up a total of 100%, so this is controlled in the “Allocation Control” field. If the percentage of this field resulting from the sum of the assigned percentages is 100%, the cell will be shown in green, if the percentage is less than or greater than 100%, it will be shown in red, which means that it will be an error that must be corrected.

The resulting distribution will be shown on the Cost Centers sheet in the field “After Costs Allocation”

This is one more step in the allocation of indirect costs, it is not the only one. Many other concepts of indirect costs remain to be distributed. But with this example you can get an idea of how we Controllers are assembling the pieces of the puzzle.

Images Employee Costs Allocation to Cost Centers Free Excel Template

More information about Controlling Tools

- Budget Sales Control Free Excel Template

- 3 Methods Selling Price Calculation Free Excel Template

- Payments Forecast Control FREE Excel Template

- Documents Management Free Excel Template M1

- Home Budget M2 Excel Template

- Marketing Plan Free Excel Template

- Balanced Scorecard Excel Template Key Indicators (KPIs) Control

- Working Hours Timesheet Free Excel Template

- Employee Management Free Excel Download

- Direct Costing Free Excel Template

- Cash Flow Control M1 Free Excel Template

- Suppliers Prices Comparative Analysis Free Excel Download

- Timesheet Control and Report Free Excel Template

- Planning and Control Projects Costs and Profitability Excel FREE Template M15

- Projects Costs Calculation and Control M3 Excel Template

- Cost product BOM components example Excel spreadsheet

- Employees Best Practices Improvements Requests M2 Free Excel Template

- Budget Control for Events M1 Excel Template

- Actual Vs Budget Excel Templates

- Decisions Sale Price Lists Calculation Free Excel Template

- Warehouse Inventory Control Free Excel spreadsheet

- Employee Costs Allocation to Cost Centers Free Excel Template

ERP ODOO Functional Consultant and Controller (Management Control & Controlling)