ROI Analysis How ODOO Makes Companies earn Money.

Any investment requires an analysis of profitability or return on investment, for this reason we make investments.

If they were not investments, they would be operating expenses necessary for the normal operation of the company.

What many companies confuse when deciding to implement a new ERP or an integrated management system (business management software) is to consider it an expense instead of an investment.

An ERP or a management system such as ODOO is a support tool for the company’s regular activity, therefore, many consider it an expense that they have no choice to assume, since they have to generate invoices to customers, record purchases invoices and in most cases keep the accounting to present the official books and generate the tax models.

In other words, having the obligation to present certain accounting information to the administration, it is considered an obligation to have a software that performs this function, or alternatively, to have it carried out by an external company. But finally it is considered an expense.

When a company decides to implement an ERP, be it ODOO, NAVISION, SAP, SAGE… it should change its approach when considering it an investment rather than an expense.

Just the step of deciding to implement an ERP assumes that the system will help the company to improve in many aspects.

The question is what aspects can be improved, what benefits does it bring to the company, what impact is it going to have on the income statement and the company’s treasury… when is the investment going to be recovered and what net cash flow is this going to generate?

In other words, what is the return on investment of implementing an ERP.

If you carry out an analysis of the ROI in ODOO, you will realize that it is difficult to measure the benefits that are going to be obtained.

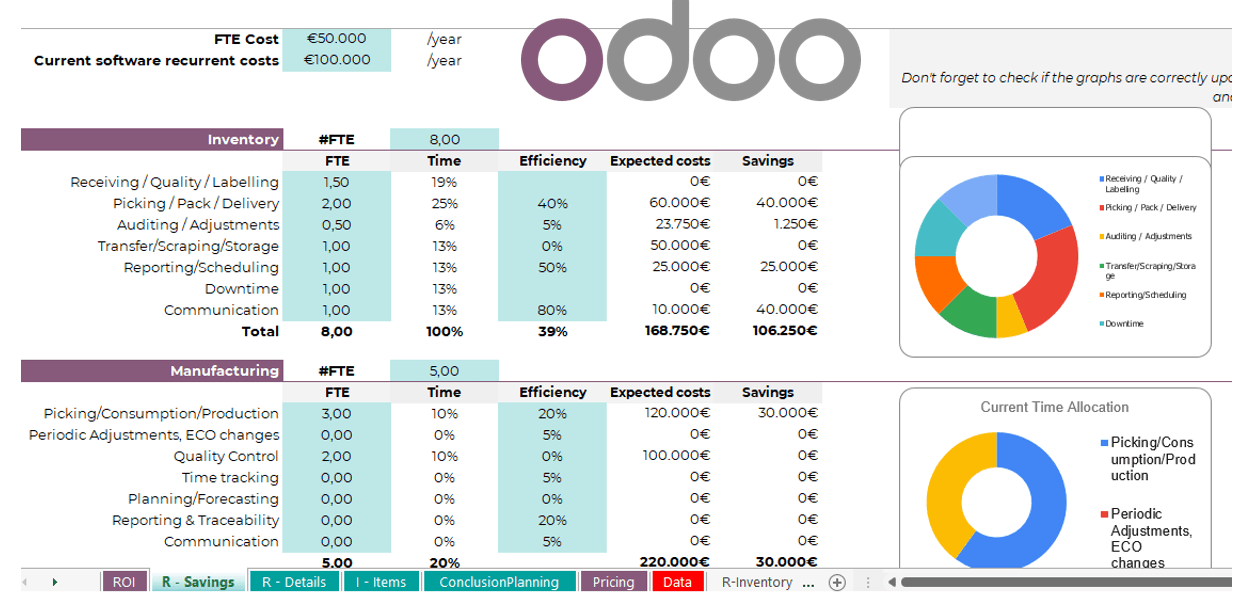

The developer company of ODOO proposes through a methodology to analyze each of the current processes of the company to determine what savings can be achieved.

The methodology proposed by ODOO is mainly based on saving process costs, that is, if you previously carried out a very manual process, the integration and automation of ODOO will allow you to reduce administrative times.

This is true, but difficult to quantify in a study unless a lot of time is spent making measurements.

Forecasts can be made about the efficiency of ODOO processes, but you have to be realistic in an ERP, human errors are also made and a lot of time is wasted fixing them.

So perhaps the time saved on process automation is lost on rectifying errors.

ODOO also proposes to take into account the savings in inventory reduction thanks to planning and control, but this is also difficult to quantify since the savings can be determined by a reduction in the time of employees working in the warehouse, the saving space in the warehouse and reducing financial expenses caused by excess stock.

A skilled consultant can sell to the company arguing savings generated in other companies, but in reality it is difficult to quantify.

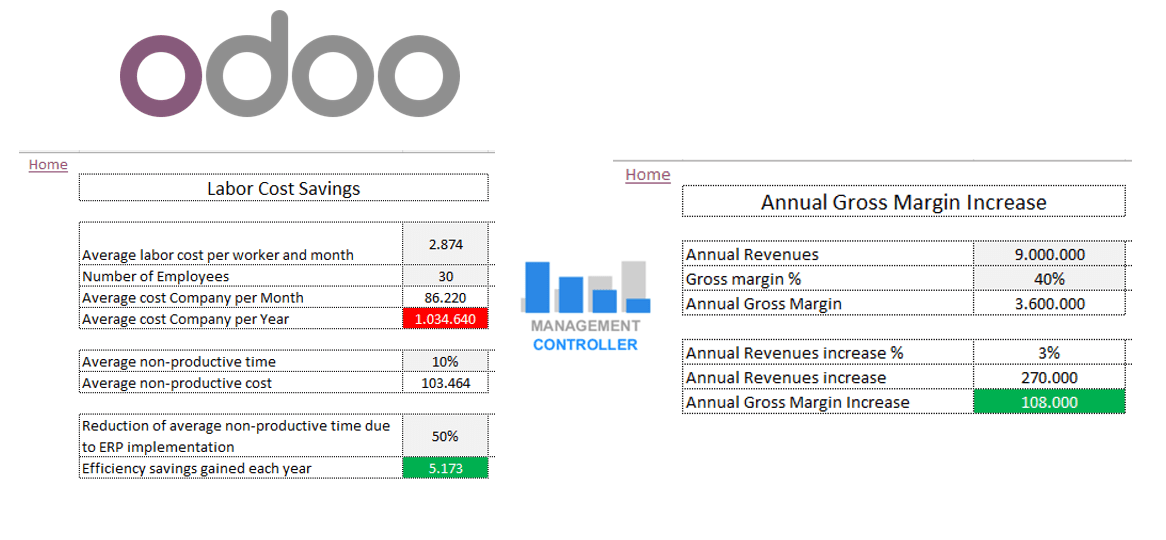

Something that ODOO does consider in its ROI analysis is that the ERP helps to increase sales, and this is a demonstrable fact.

If the company did not use a CRM, thanks to it the organization of the commercial department can be improved, potential clients and commercial activities can be tracked. There may be synergies between the commercials to improve the acquisition and closing of sales, good practices can be shared. Detect the causes of failed sales to correct future success rates….

Communication with customers can be improved, and sales can be automated thanks to e-commerce or B2B platforms.

Cross-selling or up-selling techniques can be used.

In other words, digitization and new technologies integrated into an ERP facilitate a greater capture of potential customers and an improvement in conversion rates.

This implies an increase in annual sales, it also implies an increase in the gross margin each year.

If you calculate these data, you will realize that the increase in the gross margin leaves a lot of money for the company and is easier to quantify.

Savings thanks to the implementation of an ERP are sure to be, but they are more difficult to quantify and will be less than an increase in total gross margin.

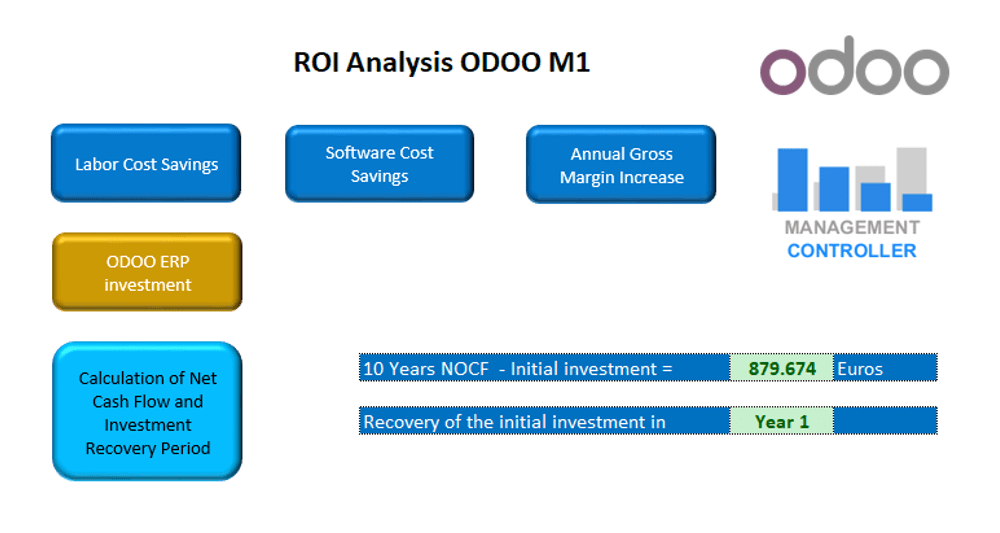

At the end, the calculation we make of the ROI will consider the potential labor savings, the software savings that the company currently has and, most importantly, the increase in gross margin derived from the increase in revenues each year.

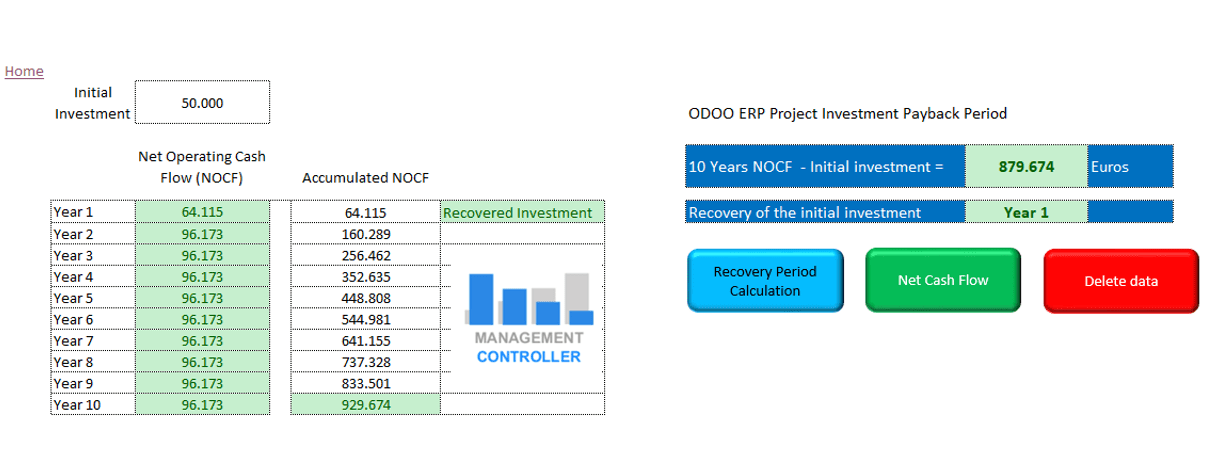

These benefits, discounting the initial investment of the ERP and the annual expenses of maintenance, support, training… will allow the calculation of the Net Operating Cash Flow that the company will obtain each year.

So in a simple analysis report it will be possible to determine the total net profit that a company can obtain after 10 years.

Considering that this is the useful life of the ERP to be implemented.

But all this is useless if the benefits that the implementation of the ERP has brought are not subsequently tracked.

How to measure the real benefits that the ERP has brought?

The reality is that it is difficult to separate them from other investments, measures or decisions that the company has made.

If we analyze an analytical income statement report after the implementation of an ERP, the impact on sales revenue, gross margin, structure costs, financial expenses and the result before taxes, the improvements can originate from different sources not only thanks to the help of the ODOO ERP management.

Is detecting the source of those improvements worth it? Possibly not, what really interests the company is to improve its income statement and the impact it will have on its cash position.

But then how can we plan and control the improvements in the income statement? Just looking at and analyzing a Profit and Loss account? Obviously not.

What the company needs is a tool that allows the anticipation of results through realistic forecasts and that facilitates decision-making and the execution of corrective measures.

For this reason, when an ERP like ODOO is implemented, a budget control system should also be implemented, not only to plan, control and analyze current results but also future results.

Part of this improvement in results will be due to the good use of the ERP ODOO by the company.

Those companies that already have ODOO implemented and also implement a budget control system, are more likely to improve results than those that do not.

Take a look here the Budget Control system that I implement for ODOO.

More info about BUDGET CONTROL service

More info about BUDGET CONTROL methodology

Download a DEMO of the 2kM15 version Budget Control.

Download Budget Control Ytd FyFcst M15 Example of Budgetary Control Reports

J.A.T

This way of keeping a budget control changes everything. We had never tried it because we did not think it would be useful. But with Dani’s methodology we now see the potential and we think it will help us in very many ways.

R.M

The Budgetary Control technique and tool is helping us to better manage expenses and that allows us to make better decisions. A great contribution to our management control.

Contact for more information

ContactMore information about Controlling Excel Tools

- E-Commerce KPIs Control Excel Template

- Human Resources Excel Templates

- Budgetary control System with Projections example

- What is Budgetary Control?

- Excel Template Cash Flow Forecast M15

- KPI Sales and Commissions Control Excel Template

- Hotels Excel Cost Calculation

- How to calculate costs in a Company

- 3 Methods Selling Price Calculation Free Excel Template

- CRM Excel Template M3 PRO

- Travel Expenses Control M1 Free Excel Template

- Download Example of Excel thermometer chart

- Excel Template Action Plan PRO

- What is an Excel Action Plan template and how can it help you?

- Impacting Charts for your Excel Templates

- Does a company need to automate or optimize administrative tasks?

- Excel Budget BOM Manufacturing Costs and Margins M15

- Timesheet Excel Template PRO

- Timesheet Control and Report Free Excel Template

- What are the benefits of a Budgetary Control System

- Financial Planning Scenarios Excel Template

- How to use an organizational chart KPI Excel template to improve your business performance

More Videos about Management Accounting

Industrial company financial manager

Dani is helping us to use ODOO more efficiently, we are rapidly leveling up with the ERP. It is also preparing us very useful analysis and control reports and outstanding management tools. Always available by phone or email, willing to help and collaborate in everything that is proposed. Very professional and fast work. A key service for our company.

Controlling Consultant

Controller ODOO ERP

Email: dani@cashtrainers.com