How to know how much money your company will earn at the end of the year.

Most companies don’t care how much money they’re going to make at the end of the year.

Or do they care?

Unconsciously, all of us have a mental reference of how much we can spend per year and how much we can save or invest, otherwise we would surely exceed our expenses compared to our income level.

Almost all of us know approximately how much we are going to earn a year, even those people who have variable wages according to achieve their objectives.

We all have a mental map of how much we are going to earn, which allows us to make decisions about how much we can spend, how much we can get into debts, and how much we can save or invest.

But if we have different sources of income and numerous items of expenses, our mental map becomes a nebula, the more variables there are in the equation, the more difficult it will be to perform mental calculations.

Having a surplus at the end of the year of 30,000 is not the same as having 5,000, savings and investment decisions are not the same, similar happens with decisions regarding the need to study for external financing.

Many people choose to keep track of income and expenses in a notebook, or spreadsheet or mobile app. Click here for an Excel model to track monthly personal income and expenses.

This type of record of income and expenses that people do is the equivalent of ACCOUNTING in companies.

Companies keep accounting as a record of the income and expense transactions they have generated and to know what they have pending collection and payment, as well as to record the value of their assets and liabilities.

But what people as well as companies rarely do is put in that notebook, spreadsheet or mobile application what is the spending limit they can have based on the income they expect to generate, that is, how much net money they expect to get at the end of the year.

This is what in business terms is called BUDGET.

Many will know the term budget because nothing else is talked about in the news and sports circles related to football clubs.

The teams have a budget to be able to sign and spend especially on salaries and wages of the players.

The budget is determined by the expected income for this year, that is, player sales, television income, advertising, merchandising, season ticket sales and field tickets…

If the clubs exceed the budget, it is normal that they have to look to external financing or entry of external capital to remain competitive.

A football club, unlike other types of activities, does not have the objective of obtaining profits, at least not directly for the shareholders. Possibly these obtain them indirectly.

The objective of a football club is usually to obtain titles or sporting achievements, these are more important than economic benefits, for this reason many clubs have exceeded expenses over income for years.

The companies do not have as objective the obtaining of prizes or business titles. Their reason for existence is normally economic, remaining aside social companies or public companies.

Investors in companies expect them to be profitable, generate profits that allow the value of the company to increase, so the value of their shares will increase and if they are sold they can obtain significant capital gains.

At the same time, profitability is closely linked to the liquidity of the company, so normally this type of company, without giving up external financing, usually has a balanced and healthy financing system.

A football club, despite having mainly an extra-economic objective, needs to have a well-defined annual or season budget.

In this way the club can have an operational plan to achieve the sporting goals. Sale and purchase of players, negotiation with sponsors, television rights, subscription and ticket prices, salaries of players and other employees, travel expenses, maintenance of football fields, investments in fields and facilities…

But as the year or season progresses, what the club has established as an objective is normally not fulfilled.

There are external and internal situations that are going to change. Situations to which you have to adapt and make decisions as they are expected to occur.

The initial budget is immovable, what changes are the forecasts until the end of the year as the external or internal situation changes.

An external situation can be, for example, the one caused by the COVID pandemic, which for many months did not allow spectators to go to the fields, thus reducing part of the income.

An internal situation can be the dismissal of a coach or the need to sell or buy players in the middle of the season.

External situations are determined by changes in market trends, increase or decrease in demand, may be the result of uncontrollable situations, such as the entry of a strong competitor.

Internal situations are determined by decisions or corrective actions that allow the end of the year to reach the economic objective, for example, a price reduction through temporary offers can reactivate demand, but this in turn would imply an increase in purchases of direct materials, and the need to hire more employees to absorb that demand.

Many variables come into play when one of the company’s keys is touched.

The forecast of these variables will allow us to know how much money will be earned at the end of the year.

Now you can think that budget and forecasts are similar and should go in the same direction.

Just the contrary, the budget is the objective set before the year begins, however the forecasts will be adjusted as we have information and decisions are made.

One very important thing about the forecasts is that as the months progress we have real information, so the forecasts for the remaining months are usually more reliable and realistic than at the beginning of the year.

Thanks to the forecasts you will know how much money you are going to earn at the end of the year, regardless of whether we are in the month of January or in the month of September.

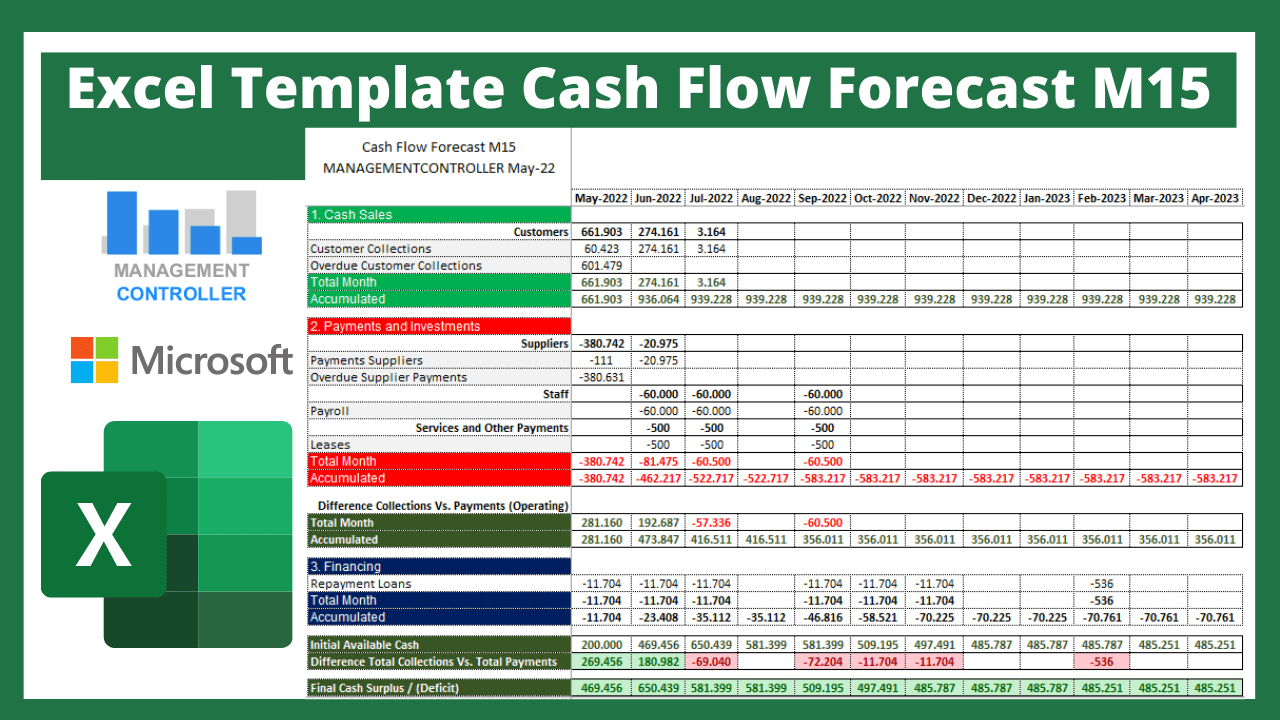

This is the key to success and the greatest value provided by a budget control system, being able to use forecasts together with real results of the months closed for accounting purposes in order to make the right decisions that allow the achievement of the objective (budget) established at the beginning of the year.

In order to use this high value-added methodology for management, you will need a budget control system that includes forecast management, like the one you can see below.

Budget Control Excel Year-to-Date & Full-Year Forecast Download Budget Control Excel M15 Download Excel Cash Flow Forecast Report M15

More information about Controlling Excel Tools

- How to calculate costs in a Company

- CRM Free Excel Templates

- The 3 Key Models to avoid the Economic Crisis in Companies

- Inventory Control and Dashboard Excel Template

- Excel Spreadsheet for SWOT Analysis

- What are Production Costs

- FREE Excel Balanced Scorecard 2KM15

- Not performing a budget or budgetary control is equal to death according to FERRAN ADRIA

- Tracking Shipments Excel Template

- How to know how much money your company will earn at the end of the year

- Dashboard Layout Excel Templates

- Documents Management Free Excel Template M1

- Excel Template Daily Sales Control

- Budget Control Excel Year-to-Date & Full-Year Forecast M11

- Retail Commerce Profit Analysis Free Excel Template

- Customer Invoices Free Excel Template

- Employee Management Free Excel Download

- Cost Accounting. What benefits contribute to the company

- Human Resources Excel Templates

- Management Budget Control Easy Theory Difficult Implementation

- Business Plan Budget 5 Years M1 Free Excel Template

- Excel Template Employee Training Control

More Videos about Management Accounting

Industrial company financial manager

Dani is helping us to use ODOO more efficiently, we are rapidly leveling up with the ERP. It is also preparing us very useful analysis and control reports and outstanding management tools. Always available by phone or email, willing to help and collaborate in everything that is proposed. Very professional and fast work. A key service for our company.

Controlling Consultant

Controller ODOO ERP

Email: dani@cashtrainers.com