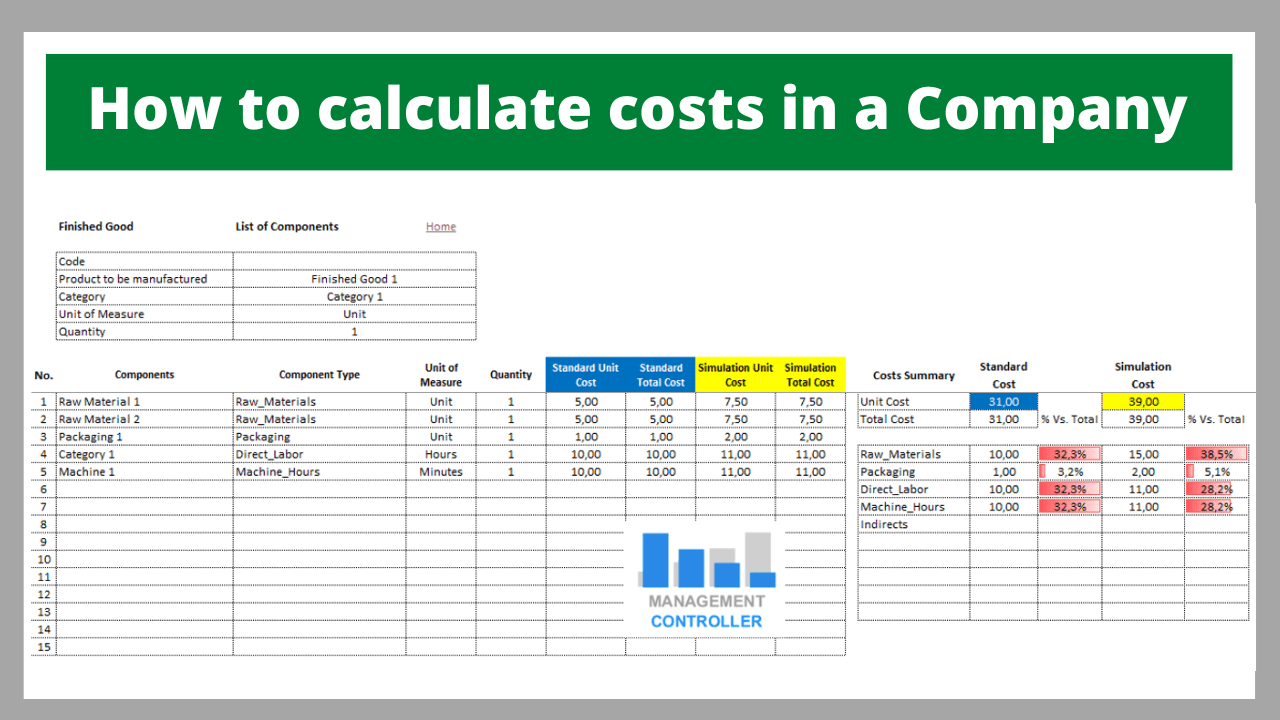

How to calculate costs in a Company.

Calculating costs is an essential business skill that can help you create budgets, forecast sales, determine profitability, and plan for upcoming expenses.

Performing cost calculations correctly will help you make better business decisions and increase your efficiency.

Calculating costs can seem overwhelming, but it doesn’t have to be. In this post, we’ll explain the basics of costing and provide you with some examples to help you get started.

What are the different types of costs?

When calculating costs, it is important to consider three different types of costs: fixed, variable, and semi-variable.

Fixed costs

Fixed costs are those that remain consistent regardless of how much the company produces or sells. Examples of fixed costs include rent, taxes, and insurance.

Variable costs

Variable costs are those that fluctuate directly with production or sales. Examples of variable costs include raw materials, labor costs, and shipping.

Semi-variable costs

Semi-variable costs are costs that are a combination of fixed and variable costs.

An example of a semi-variable cost is electricity, which typically has a fixed portion (monthly rate) and a variable portion (cost of electricity used).

How to Calculate Fixed Costs

To calculate fixed costs, simply add up all the fixed costs associated with your business.

For example, if you pay a monthly rent of $1,000, monthly taxes of $200, and a monthly insurance of $100, then your fixed costs are $1,300 per month.

How to Calculate Variable Costs

To calculate variable costs, you must first know how much of the variable cost is associated with each unit of production or sales. For example, if you produce 100 widgets and each widget requires $10 of raw materials, then your variable cost is $1,000 ( 100 x $10 ).

Once you know the variable cost for each unit, add up the total variable costs for all units produced or sold. For example, if you sold 100 widgets for $10 each and each widget costs $10 in raw materials, then your variable cost is $1,000 ( 100 x $10 ) and your total revenue is $1,000 ( 100 x $10 ).

How to calculate semi-variable costs

To calculate semi-variable costs, you must determine the fixed portion and the variable portion of the cost. For example, if you pay a monthly fee of $100 for electricity and use 500 kilowatts of electricity each month, then the fixed portion of the cost is $100 and the variable portion is $500 (500 kilowatts x $1/kilowatt). Once you know the fixed and variable portions, add them together to calculate the total cost. In this example, the total cost is $600 ( $100 + $500 )

Example of Total Cost Calculation

Let’s say you produce 100 widgets and each widget requires $10 of raw materials, $5 of labor, and $1 of overhead costs. To calculate the total cost of producing 100 widgets, you must first calculate the variable costs. The variable cost of producing 100 widgets is $1,500 ($10 x 100 for raw materials + $5 x 100 for labor + $1 x 100 for overhead). Next, you need to add the fixed costs associated with your production. Let’s say you have a fixed cost of $500. The total cost of producing 100 widgets is $2,000 ($1,500 variable costs + $500 fixed costs).

Conclusion on How to Calculate Costs

Calculating costs is essential to making smart business decisions. To do this correctly, you need to understand the different types of costs and how to calculate each one. By following the steps in this article, you will be able to calculate all the costs associated with your business and make better decisions about your production, budget, and pricing.

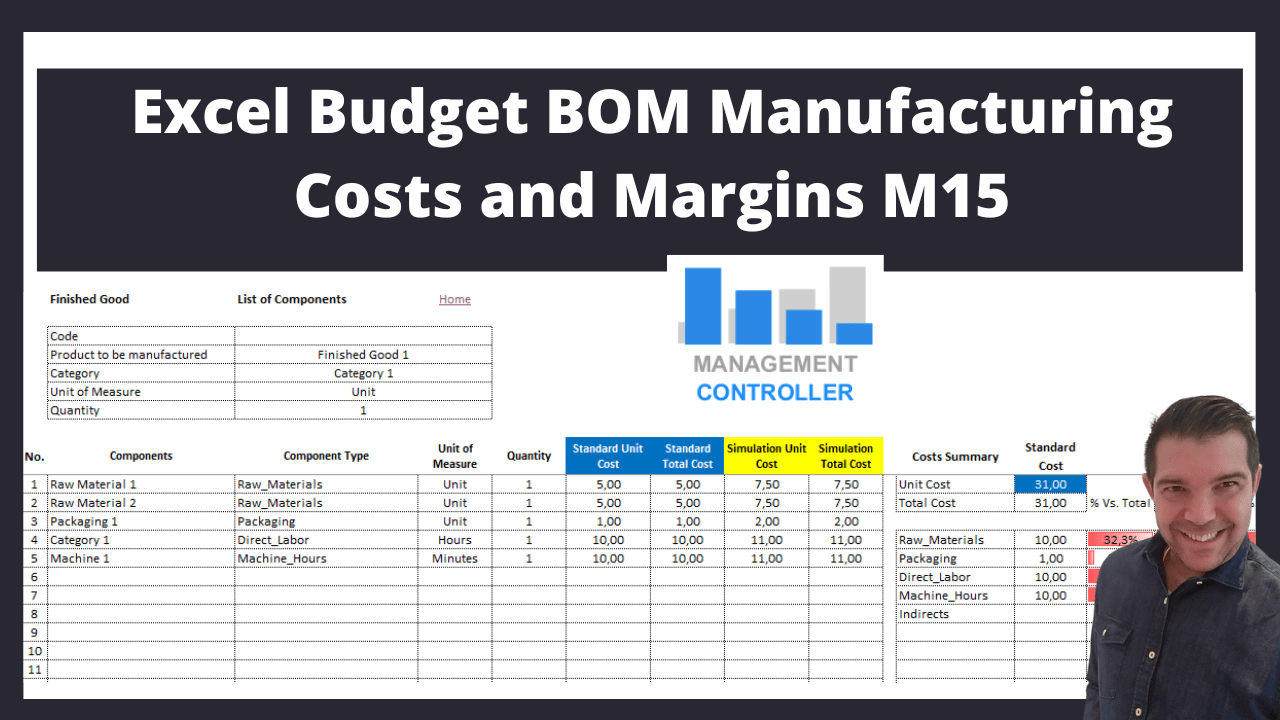

Example Excel Budget BOM Manufacturing Costs and Margins M15

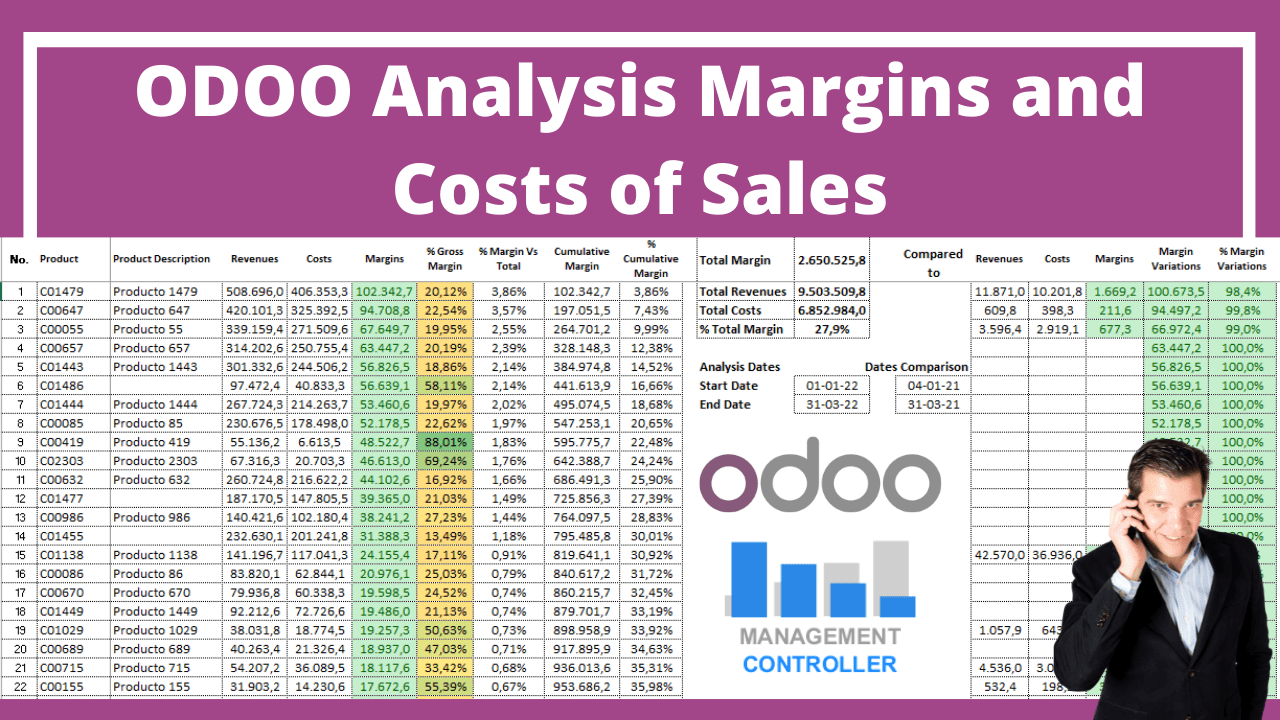

Example ODOO Analysis Margins and Costs of Sales

Press here to find free excel templates for cost calculation here.

More information about Controlling Excel Tools

- Home Budget M2 Excel Template

- KPI OEE Report Excel Free Template

- Multiproducts Breakeven Simulator Free Excel Template

- Excel Budget BOM Manufacturing Costs and Margins M15

- Training Courses Control Free Excel Template

- Decisions Sale Price Lists Calculation Free Excel Template

- Jooble Bad Practices and Reviews SEO and Backlinks Strategy

- Financial Business Excel Templates

- Issues and Tasks Management Control Excel Template

- Excel Template Human Resources HR Management Control

- Management Budget Control Easy Theory Difficult Implementation

- What is a Decision Matrix and Example Excel Template

- Excel Template Matrix for Decisions

- Inventory Turnover and Coverage Calculation Free Excel Template

- Restaurants Sales forecast Free Excel Template

- Timesheet Control and Report Free Excel Template

- Budget Control Excel YTD & FYForecast M15

- Working Hours Timesheet Free Excel Template

- Employee Costs Allocation to Cost Centers Free Excel Template

- Balanced Scorecard M1 Excel Template

- Projects Control with Tasks Free Excel Template

- Marketing Plan Free Excel Template

More Videos about Management Accounting

Industrial company financial manager

Dani is helping us to use ODOO more efficiently, we are rapidly leveling up with the ERP. It is also preparing us very useful analysis and control reports and outstanding management tools. Always available by phone or email, willing to help and collaborate in everything that is proposed. Very professional and fast work. A key service for our company.

Controlling Consultant

Controller ODOO ERP

Email: dani@cashtrainers.com